Go to article by clicking on image.

Go to article by clicking on image.

|

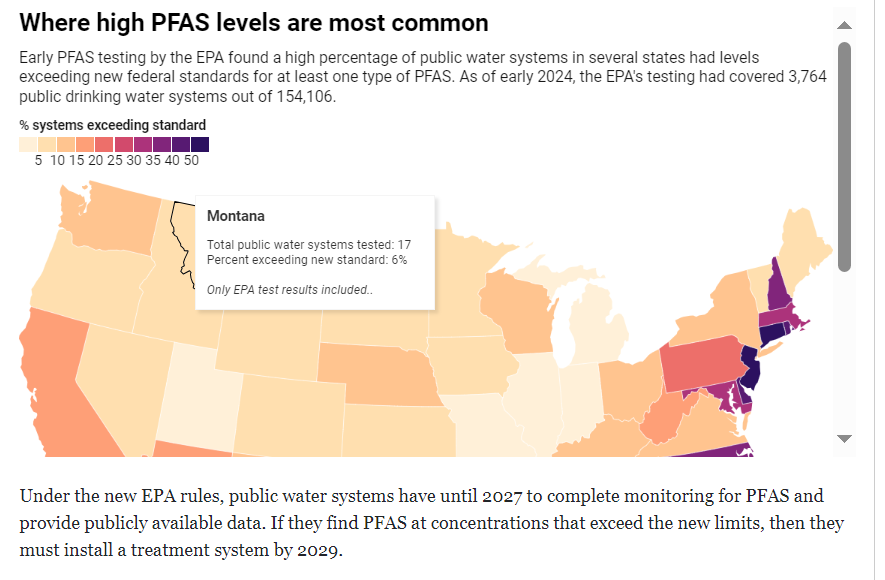

If you sell AWGs, I think the interactive map accompanying this Water Online article could serve as a useful guide for where to focus AWG marketing efforts in the USA.  Go to article by clicking on image. Go to article by clicking on image.

0 Comments

Some people prefer eBooks, others prefer printed books. Your choice!

Ad spaces on the Atmoswater Research web site are now available at substantial cost reductions. Spaces cost USD 60 on the page Atmospheric Water Generator or Water-from-Air Machine Suppliers Links and USD 50 on the page Case Studies About Water-from-Air.

Our latest publication is available as an eBook (PDF). This handbook includes active companies and tables detailing specifications of their atmospheric water generator products. You can order it at the Atmoswater Shop.

Water-from-air technologies are attracting serious attention as shown by a recent editorial in the journal Nature Water. Highlights from the editorial include:

Water News Europe published this article in July 2023 outlining the present state of the water-from-air industry. Several industry sources are referenced, including Roland Wahlgren, Atmoswater Research.

Peer-reviewed articles, even about water resources, can be a dry read. But not so for the recently published Open Access article, Increasing freshwater supply to sustainably address global water security at scale. Let me share four excerpts from the paper to inspire and energize us in the water-from-air community. The excerpts show we do indeed have a crucial role in improving access to drinking water.

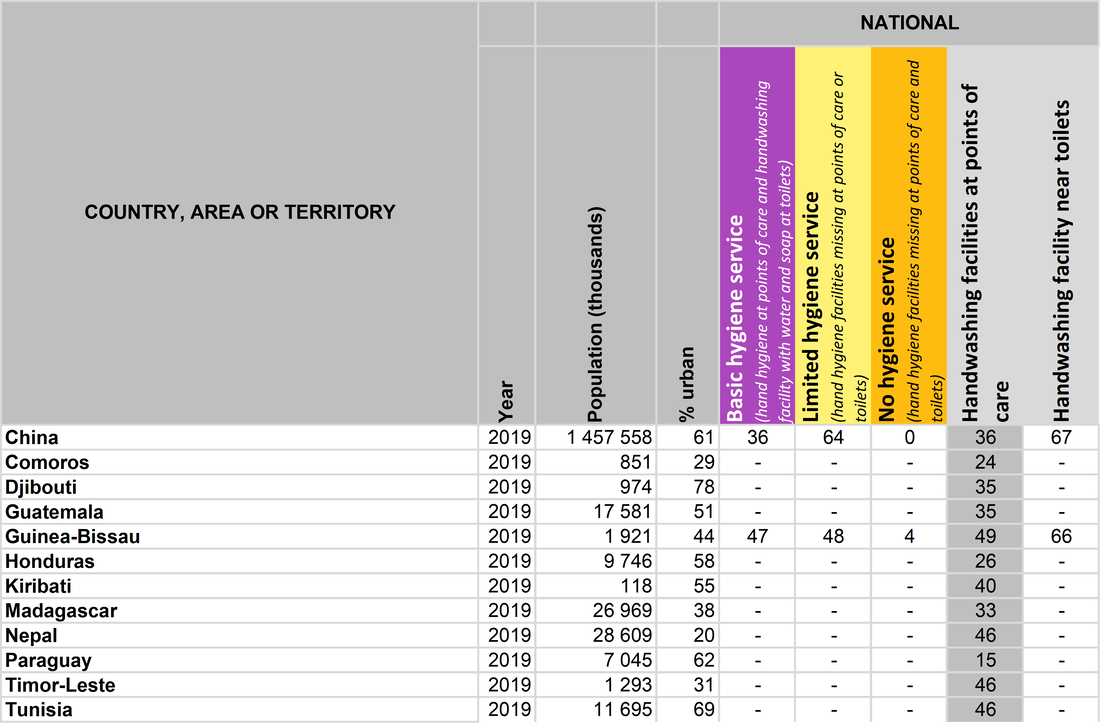

- "...reducing and managing [water] demand are proving inadequate as population and economic growth quickly absorb any capacity that is created through these measures." - "Recycling and reuse of water...have limited scalability because they are fundamentally constrained by the available supply." - "Effective solutions to increase the [fresh water] supply are at present limited, or they are practically non-existent since all resources are being exploited beyond sustainable capacity or rapidly dwindling due to climate change." - "Desalination is not only energy intensive; it also creates concentrated brine and other byproducts that create significant environmental challenges with the cost of disposal." The authors proceed to outline their proposal for a system for siting water vapor collection systems above the surface of the ocean and then transporting the vapor to condensation systems on the nearby shore. They discuss the water vapor resource, the insignificant impact of climate change on viability of their system, the negligible environmental impact, and the financial feasibility. The research trio also claim their ocean-based system will benefit from a higher moisture flux compared to land-based water-from-air installations. The merits of the system outlined in the article remain to be validated but the important learnings from the article for those of us in the water-from-air industry are the quotations about the continuing inability of conventional water resources to provide global water security---thus giving incentive to our industry leadership to continue working diligently to prove the value of developing and commercializing water-from-air technologies. Reference Rahman, A., Kumar, P. & Dominguez, F. (2022). Increasing freshwater supply to sustainably address global water security at scale. Sci Rep 12, 20262 (2022). https://doi.org/10.1038/s41598-022-24314-2. This is an Open Access article. Here I refer again to statistics from UNICEF’s Water, Sanitation and Hygiene in Healthcare Facilities: Global Baseline Report 2019 which is found at: https://data.unicef.org/resources/wash-in-health-care-facilities/?mc_cid=f5b26e1fed&mc_eid=1956e675a7) The UNICEF report stated, “In 8 out of 55 countries with data available, more than half of health care facilities lacked handwashing facilities at points of care in 2016”. This is an urgent need that could be filled by appropriately designed AWGs. Today's post presents data about healthcare facilities with no handwashing facilities (Table 7, below).  Table 7: Twelve countries, areas, or territories where more than half of healthcare facilities lacked handwashing facilities at points of care. This 2019 data is for 72 of 165 countries in the database. For 93 countries there is no data for hand hygiene materials at points of care. This table was condensed by the writer from a larger table. Data source: Progress on household drinking water, sanitation and hygiene 2000-2020: five years into the SDGs. Geneva: World Health Organization (WHO) and the United Nations Children’s Fund (UNICEF), 2021. Licence: CC BY-NC-SA 3.0 IGO. Data gaps are indicated by a dash (-). The detailed statistical table from which the tables are derived is too large to reproduce in this blog series. The detailed table is available at https://washdata.org/data/downloads (select “World File” under “Health Care Facilities”). Water service data is given for the following regional groupings of healthcare facilities:

This is the final post in this 7-part series about water-from-air market analyses based on the UN's Sustainable Development Goal 6 (Clean Water and Sanitation). Perhaps this series will inspire readers to initiate projects aligned with SDG 6. This alignment will create a demand for AWGs designed to address needs beyond household drinking water. AWGs are needed for household sanitation, basic water services in schools, handwashing in schools, basic water services in healthcare facilities, and healthcare handwashing facilities. Innovative business models are needed to allow water-from-air system suppliers to participate in achieving SDG 6 targets. Statistics from UNICEF’s Water, Sanitation and Hygiene in Healthcare Facilities: Global baseline report 2019 https://data.unicef.org/resources/wash-in-health-care-facilities/?mc_cid=f5b26e1fed&mc_eid=1956e675a7) show the commercial potential for AWGs in the healthcare facility market in two market segments:

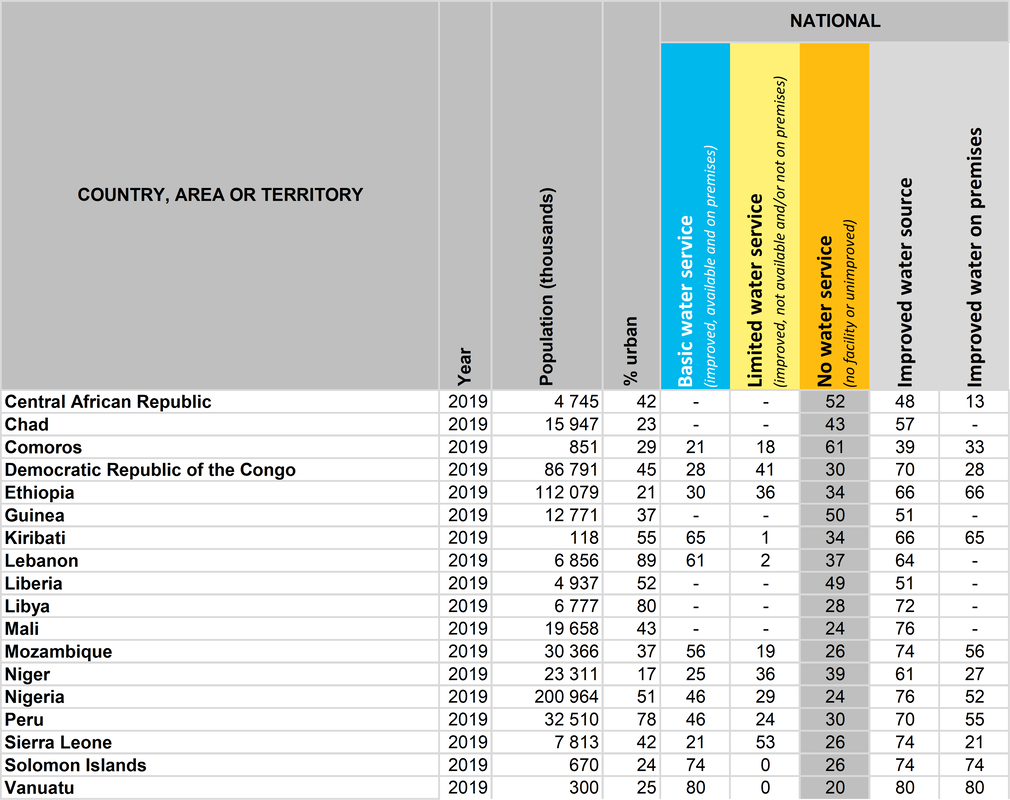

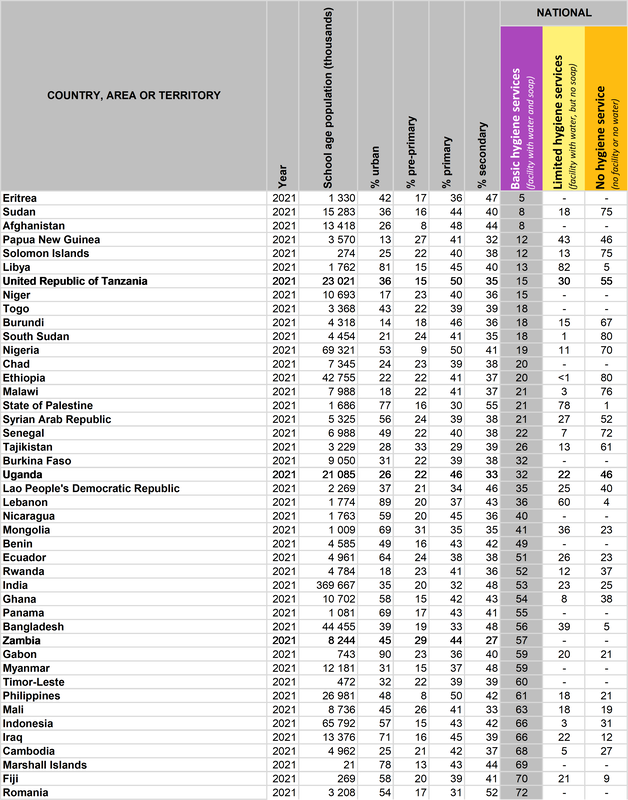

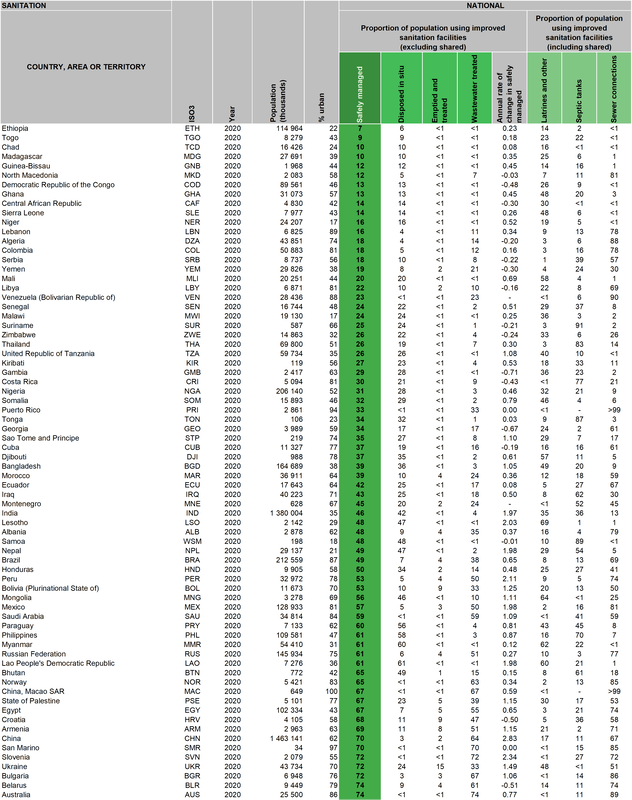

An estimated 896 million people use health care facilities with no water service and 1.5 billion use facilities with no sanitation service. It is likely that many more people are served by health care facilities lacking hand hygiene facilities and safe waste management. Today's post presents data about healthcare facilities with no water service (Table 6, below).  Table 6: Eighteen countries, areas, or territories have no water service in at least 20% of their healthcare facilities. This 2019 data is for 79 of 165 countries in the database. For 86 countries there is no data for no water service in healthcare facilities. This table was condensed by the writer from a larger table. Data source: Progress on household drinking water, sanitation and hygiene 2000-2020: five years into the SDGs. Geneva: World Health Organization (WHO) and the United Nations Children’s Fund (UNICEF), 2021. Licence: CC BY-NC-SA 3.0 IGO. Data gaps are indicated by a dash (-). Basic hygiene services in schools depends on clean water being available for handwashing. AWGs could be designed specifically for this application. Table 5 below shows the national statistics. The world file tables available at https://washdata.org/data/downloads also show urban and rural statistics so quite detailed market analyses are possible.  Table 5: Forty-four countries, areas, or territories have school basic hygiene services less than 75% of the school age population. This data is for 121 out of 180 countries in the database. For 59 countries there is no data for school basic hygiene services. The blog author condensed and sorted the data according to lowest to highest national proportion of basic hygiene services. Data source: Progress on household drinking water, sanitation and hygiene 2000-2020: five years into the SDGs. Geneva: World Health Organization (WHO) and the United Nations Children’s Fund (UNICEF), 2021. Licence: CC BY-NC-SA 3.0 IGO. Data gaps are indicated by a dash (-). It is often said that children are our future. This truism may explain the special interest shown by WHO and UNICEF in compiling statistics about school drinking water services (Table 4, below) and school basic hygiene (Table 5, to be posted later in Part 5 of 7). There is commercial potential for AWGs designed for use in schools in drinking water and handwashing applications. Drinking water AWGs for schools and AWGs for handwashing by students are market segments rarely mentioned by academic researchers developing AWGs and by businesses offering AWG products. Welcome exceptions are the atmospheric drinking water fountain products by Hydrosphair and Skywell. The tables show the enormous potential for appropriately designed AWGs. These tables show the national statistics. The world file tables available at https://washdata.org/data/downloads also show urban and rural statistics so quite detailed market analyses can be done. Countries, areas, or territories with school drinking water services less than 75% of school age population are listed here in Table 4.  Table 4: Forty-four countries, areas, or territories have school basic water services less than 75% of the school age population. This data is for 133 out of 180 countries in the database. For 47 countries there is no data for school basic water services. The blog author condensed and sorted the data according to lowest to highest national proportion of basic water services. Data source: Progress on household drinking water, sanitation and hygiene 2000-2020: five years into the SDGs. Geneva: World Health Organization (WHO) and the United Nations Children’s Fund (UNICEF), 2021. Licence: CC BY-NC-SA 3.0 IGO. Data gaps are indicated by a dash (-). There are seventy-two countries, areas, or territories in which less than 75% of the population lives in households having safely managed sanitation (Table 3, below). Safely managed sanitation has these two properties: improved sanitation facility not shared with other households and excreta are disposed of in situ or transported and treated off-site. Many countries in the drinking water list (Table in blog post 2 of 7) do not appear in the sanitation list (Table 3, below) because of gaps in the national sanitation data. The countries so affected do, however, have national statistics for “latrines and other”, “septic tanks”, and “sewer connections”. For the record, 16 countries were expected to be in both tables but were not (in order of lowest to highest national proportion of safely managed drinking water): Rwanda, Uganda, Afghanistan, Cambodia, Côte d’Ivoire, Pakistan, Congo, Tajikistan, Nicaragua, Guatemala, Wallis and Futuna Islands, Uzbekistan, Democratic People’s Republic of Korea, Kyrgyzstan, Albania, and Republic of Moldova. Surprisingly, the list in the Sanitation Table below contains some countries that are in the High-income group as defined by their nominal values of Gross National Income (GNI) per capita in 2020‒2021 [>US$12,695; Atlas method— indicator of income developed by the World Bank; Wikipedia: List of countries and dependencies by GNI (nominal) per capita, USD]. These high-income group countries with relatively great household sanitation challenges are: Australia; China, Macao SAR; Croatia; Norway; Saudi Arabia; and Slovenia. Because of their relatively high per capita income status, these countries are good initial marketing targets for versions of AWGs designed to provide clean water for sanitation applications.  Table 3: Seventy-two countries, areas, or territories with household sanitation safely managed less than 75%. This data is for 120 out of 234 countries in the database. For 114 countries there is no data for safely managed household sanitation. The image is an excerpt from a larger table. The blog author condensed and sorted the data according to lowest to highest national proportion of safely managed. Data source: Progress on household drinking water, sanitation and hygiene 2000-2020: five years into the SDGs. Geneva: World Health Organization (WHO) and the United Nations Children’s Fund (UNICEF), 2021. Licence: CC BY-NC-SA 3.0 IGO. Data table downloads (Microsoft Excel® format) are available at https://washdata.org/data/downloads#. Some high-income countries are in this list (see text). Data gaps are indicated by a dash (-). In Table 1 (Blog post 1 of 7 in this series), the shortfall for safely managed drinking water is 2 billion people. The shortfall for safely managed sanitation is almost twice as many people, 3.6 billion. Why? To understand the commercial potential of AWGs and formulate marketing strategies it is crucial to know the reasons. In 2014, a blog post titled “Water and Sanitation for Health: Why is Progress Slow?” was published by Q. Wodon, Lead Economist, Education Sector, World Bank and C. T. Nkengne, Economist, Poverty Global Practice, World Bank Group

(https://blogs.worldbank.org/health/water-and-sanitation-health-why-progress-slow). Their main points help to answer why:

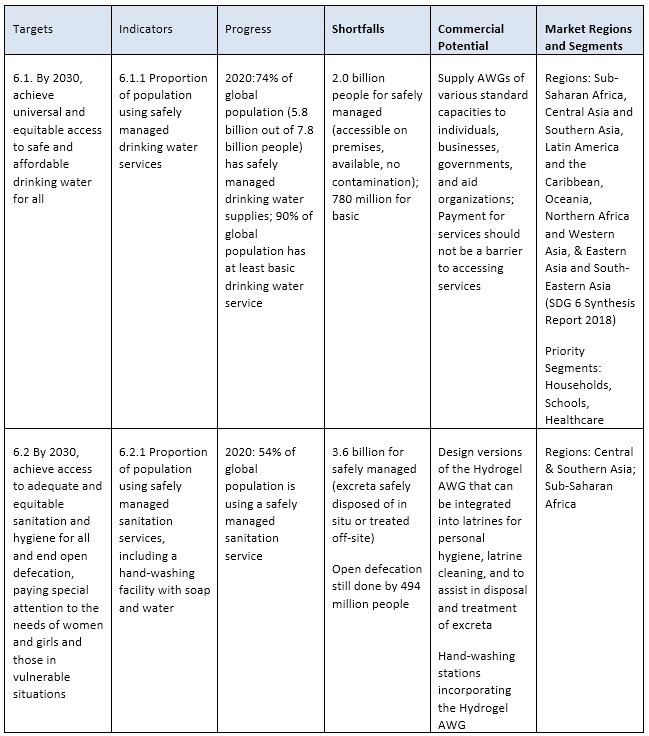

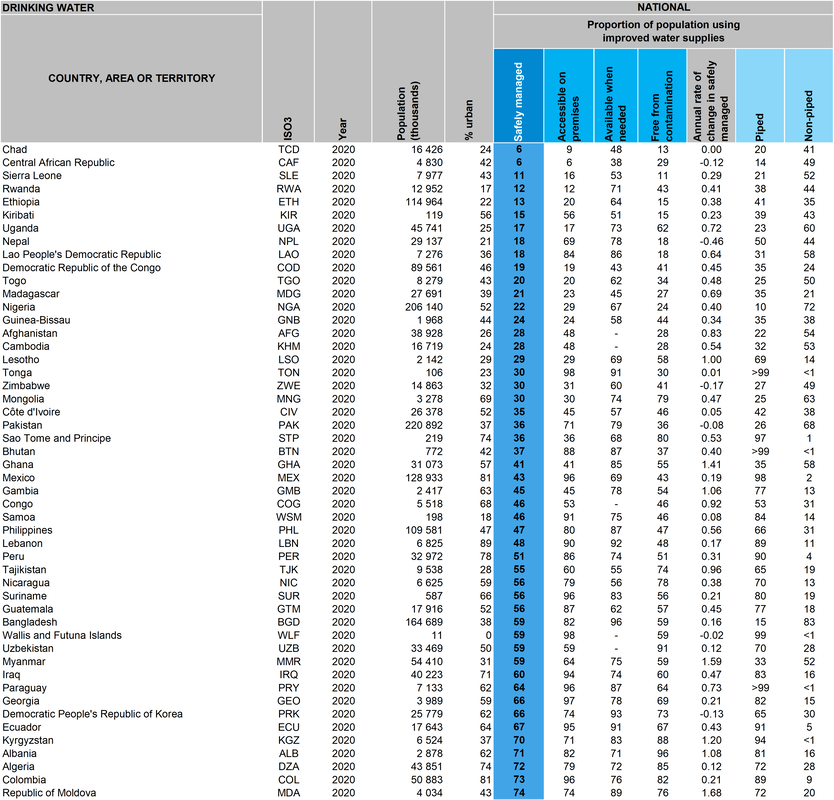

I have noted, over many years in the water-from-air field, that academic researchers and businesses are focused almost totally on providing potable water—sanitation gets mentioned rarely, if at all. But clean water is essential for personal hygiene for men, women, children, and infants—using polluted water or not having any water at all for sanitation applications has the potential for causing dreadful health problems. Designing versions of AWGs specifically for personal hygiene could be a competitive advantage that would also improve the quality of life for millions of people. Households, schools, and healthcare facilities are essential markets to focus on according to the WHO/UNICEF Joint Monitoring Program for Water Supply, Sanitation and Hygiene (JMP). JMP is the data-holding entity monitoring progress towards the SDG 6 targets. Other markets exist but those mentioned are global priorities for which improving water supplies will improve the lives of millions of people by 2030. To position an AWG technology to help solve global water scarcity problems quickly and efficiently it is wise to adopt the priority markets outlined in the data tables by the experts involved with JMP ( Table downloads at: https://washdata.org/data/downloads#). There are fifty countries, areas, or territories with data showing less than 75% of their population lives in households having safely managed drinking water (see Table 2 below). A safely managed water supply has all three of these properties: located on premises, available when needed and free from fecal and priority chemical contamination (WHO and UNICEF, 2017, p. 24). Households whose water supply lacks one or more of these properties are a commercial opportunity for AWGs. Examining the table at the national level reveals details about target markets. For example, in Uganda (seventh on the list, sorted by proportion of population using safely managed water supplies) only 17% of the population has water accessible on their premises. Despite this fact, water is available when needed for 73% of Ugandans. But, unfortunately, only 62% of people have access to water free from contamination. The statistics also show that only 23% of the improved water supply is piped—so decentralized water distribution solutions like AWGs are a good fit to the situation. The original full data tables, available from the WHO and UNICEF Joint Monitoring Program further organize the national data into its rural and urban components (https://washdata.org/data/downloads#). This allows AWG marketing strategy development to be quite efficient.  Table 2: Fifty countries, areas, or territories with household drinking water supply safely managed less than 75%. This data is for 138 out of 234 countries in the database. For 96 countries there is no data for safely managed water supplies. The image is an excerpt from a larger table. The blog author condensed and sorted the data according to lowest to highest national proportion of safely managed. Data source: Progress on household drinking water, sanitation and hygiene 2000-2020: five years into the SDGs. Geneva: World Health Organization (WHO) and the United Nations Children’s Fund (UNICEF), 2021. Licence: CC BY-NC-SA 3.0 IGO. Data table downloads (Microsoft Excel® format) are available at https://washdata.org/data/downloads#. Data gaps are indicated by a dash (-). The commercial potential of atmospheric water generators (AWGs) can be evaluated in the framework of the United Nations Sustainable Development Goals (SDGs). These global goals were set in 2015 by a unanimous vote in the UN General Assembly. The goals are to be met by 2030. The SDGs relevant to water resources make plain the urgent demand for specific products and services. They also state market segments and geographical regions that must be addressed to improve the quality of life for millions of people. In short, the SDG documents contain global market survey results, outlining concisely the big-picture problems that innovative products and services must help solve. As a reminder, and to put the water-related SDG in context, here is list of the seventeen SDGs (https://www.un.org/sustainabledevelopment/sustainable-development-goals/): 1. No Poverty 2. Zero Hunger 3. Good Health and Well-being 4. Quality Education 5. Gender Equality 6. Clean Water and Sanitation 7. Affordable and Clean Energy 8. Decent Work and Economic Growth 9. Industry, Innovation, and Infrastructure 10. Reduced Inequalities 11. Sustainable Cities and Communities 12. Responsible Consumption and Production 13. Climate Action 14. Life Below Water 15. Life on Land 16. Peace, Justice, and Strong Institutions 17. Partnerships for the Goals Each goal has a list of targets. Indicators measure progress towards achieving targets. The SDG relevant to AWG design is Goal 6, Clean Water and Sanitation. The following Table 1 is my interpretation of how SDG 6 targets translate into insights about commercial potential for AWGs and the market segments to be addressed. These insights may influence design paths taken towards the final commercial versions of AWGs. There is a lot to say about this topic, so I've prepared seven blog posts to be published as a series.

My goal is to remind readers of the scope of the water crisis. No single technology can hope to end the crisis. Solving water scarcity requires a variety of solutions applied thoughtfully region by region. Some powerful solutions are behavioral (and therefore essentially free of any cost in the long term). One example is reduction or elimination of mismanagement of surface water and groundwater. Another example is increased water conservation by individuals, businesses, and institutions. Some solutions are related to maintenance of water distribution infrastructure that should really be done anyway but require leadership and political willpower to include sufficient maintenance funds in budgets. A variety of technological solutions are also likely to be needed. Water-from-air can be a valuable gap-filler in situations where conventional water supply or conventional sanitation solutions are difficult to apply or have failed. The SDG 6-related data tables in the following posts reflect these difficulties and failures. Clearly, proponents of water-from-air technologies have an enormous range of water scarcity problems to help solve. The second blog post will look at national data for safely managed household drinking water. I trust you are enjoying your visit to Atmoswater Research and are gaining some valuable knowledge about water-from-air topics. Since 1999 the Atmoswater Research website has endeavored to provide the water-from-air community with accurate scientific & technical information---with a lot being free to access. Although consulting contracts, sales of digital goods, and advertising revenue give us an income stream it is far from being predictable and steady. Maintaining and improving this site requires a certain amount of cash flow. Therefore, we have added a "coffee jar" for those who would like to support us financially but do not have an immediate need for consulting services, digital goods, or an advertising spot. The "Buy me a coffee!" button is located on our home page, right-hand column (bottom; scroll down). Clicking the button below also opens the coffee jar which is a secure page in the PayPal system. Thanks very much for your support! -Roland Wahlgren "Buy me a coffee!" is a secure page in the PayPal system that accepts debit and credit cards in addition to PayPal payments.

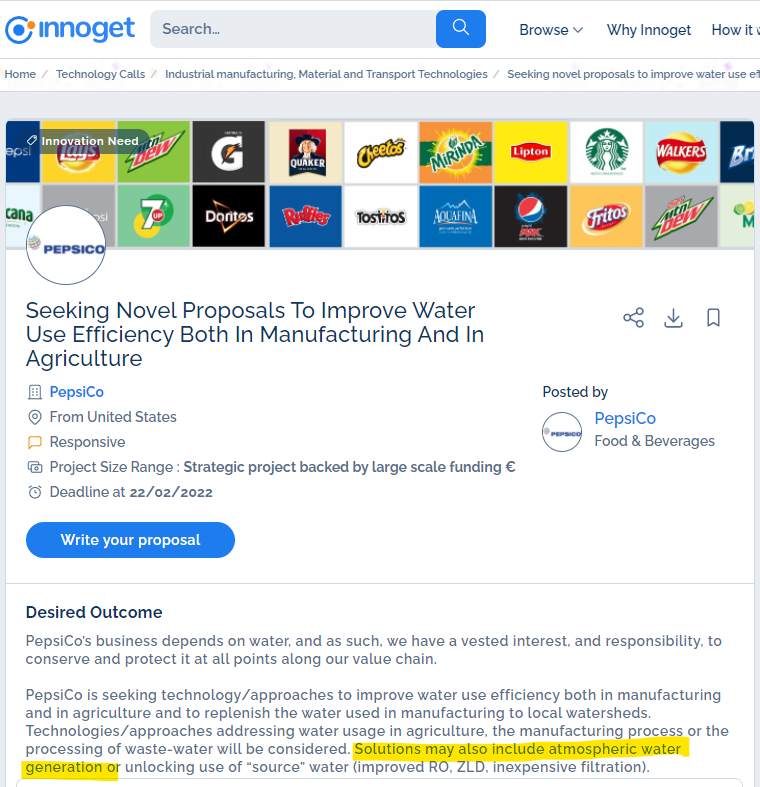

PepsiCo mentioned AWGs in its recent call for proposals to improve water use efficiency. You may click on the image above to reach the Innoget website with the proposal call.

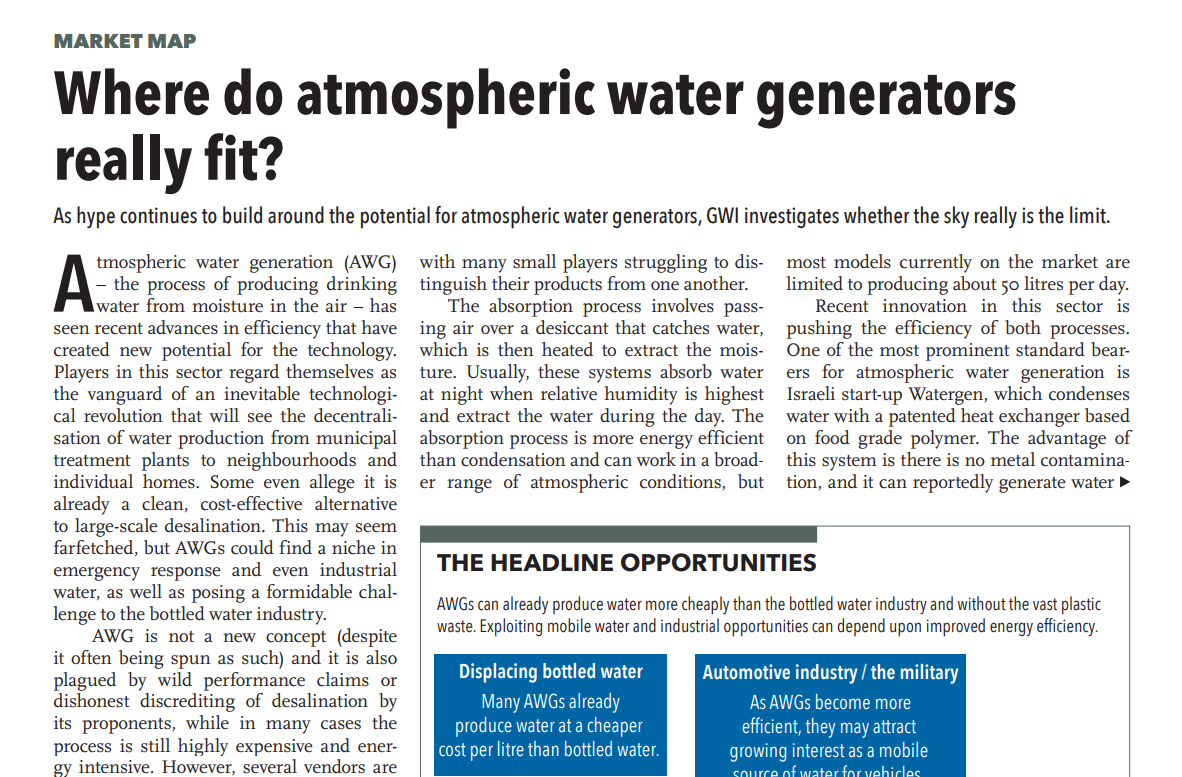

Status of the water-from-air industry in 2021 from the viewpoint of Global Water Intelligence18/11/2021 This interesting article by Global Water Intelligence (GWI) gives their view of the state of the water-from-air industry in July 2021. Drupps AB provided a link to the full article via their website.

This quotation defines the fundamental market for the water-from-air industry.

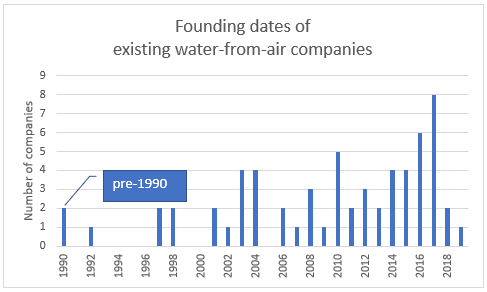

"The pandemic has exposed huge inequalities in water security, with more than 2 billion people, half of schools, and one-quarter of health-care facilities lacking a basic water or sanitation service."---as stated by 16 co-signatories in Correspondence published in Nature 583, 360 (2020). But, it is challenging to develop business models to address these markets in which the individual members seldom can afford innovations. Although technical water-from-air advancements remain important to work on, the need for business model inventiveness is likely to be even more necessary. The Water-from-Air Industry is actively growing! This chart is from the data table below tabulating the founding years for Water-from-Air companies [suppliers of Atmospheric Water Generators (AWGs)]. Companies that failed between 1990 and the present are not included. Only those companies with active websites as of today are included. Founding year information is from the company websites or the LinkedIn profiles of the companies or their founders. The two pre-1990 companies were not set up initially as water-from-air equipment suppliers. Companies started in the 2016–2017 peak years were not apparently a direct response to the Water Abundance XPrize competition which ran during 2016–2018. Founding years were not available for 11 of the 73 companies listed below. The last 10 years saw the formation of 37 firms—half of the existing companies. There has been no apparent merger and acquisition activity. Dozens of companies are marketing actively their AWGs. At least two or three dozen units are operating worldwide (see Case Studies page). According to O'Callaghan and others (2018) when "at least 3 companies actively offer versions of the technology; [with] more than 12 full-scale units in operation" this is one signal the industry is in the "Early and Late Majority" stage which can typically last 12 to 16 years. Two other signals stated by O'Callaghan and colleagues are that "Consulting engineers now specify the technology..." and "Efficiencies [are] gained in engineering design and process optimization." Reference: O'Callaghan, P. and others (2018). Development and Application of a Model to Study Water Technology Adoption. Water Environment Research, June 2018, 563–574. Data Table pre-1990 (2)

1992 (1)

1994 1995 1996 1997 (2)

2000 2001 (2)

2006 (2)

|

Roland Wahlgren

I have been researching and developing drinking-water-from-air technologies since 1984. As a physical geographer, I strive to contribute an accurate, scientific point-of-view to the field. Archives

May 2024

Categories

All

|